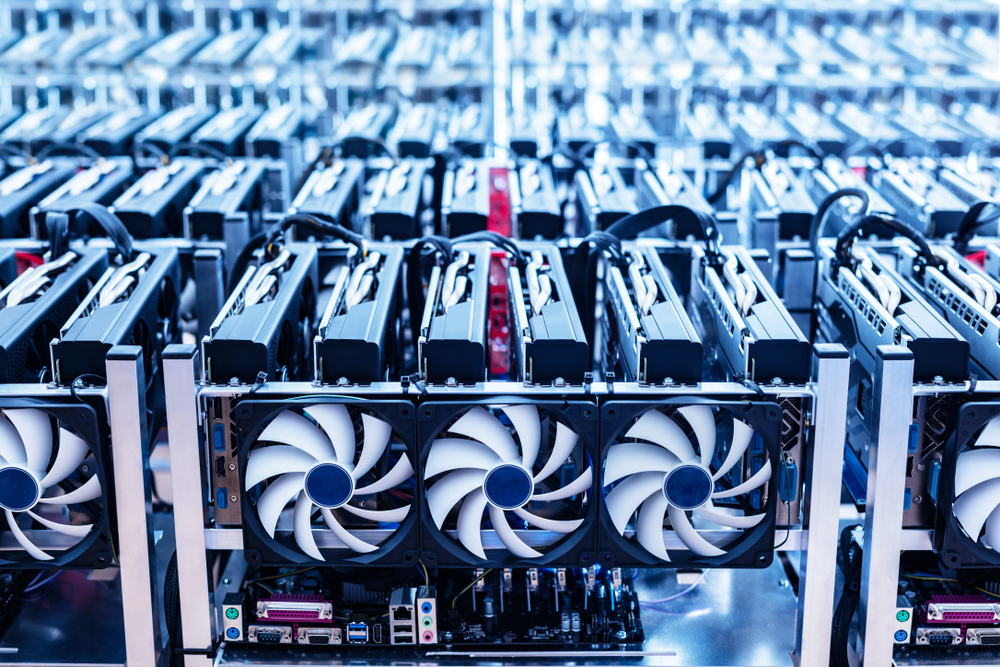

Bitcoin mining is the process of verifying transactions on the Bitcoin blockchain and adding them to the ledger, known as the blockchain. Miners use powerful computers to solve complex mathematical equations, which helps to secure the network and validate transactions. The miner who solves the equation first gets to add a new block of transactions to the blockchain and is rewarded with a certain amount of newly minted Bitcoin.

PROS & CONS:

In terms of pros and cons, Bitcoin mining can be a lucrative venture, but it requires significant upfront investment in hardware and energy costs. Additionally, the mining process is highly competitive, and miners must constantly upgrade their equipment to stay ahead of the competition. Despite these challenges, many successful miners have been able to generate significant profits, with some estimates suggesting that top-tier miners can earn up to $100,000 per month.

CAN YOU MAKE MONEY:

Mining cryptocurrency can be a profitable venture, but it’s essential to understand the competitive landscape and the factors that affect profitability. With the right equipment, energy costs, and operational strategy, it’s possible to generate significant returns.

Key Factors:

- Mining Difficulty: The difficulty of mining cryptocurrency is constantly adjusting to ensure that new coins are mined at a consistent rate. This means that as more miners join the network, the difficulty increases, making it more challenging to mine.

- Hash Rate: The hash rate of your mining equipment determines how many calculations it can perform per second. A higher hash rate increases your chances of solving the complex mathematical equations and earning rewards.

- Energy Costs: Mining cryptocurrency requires significant amounts of energy to power your equipment. High energy costs can quickly erode your profits.

- Equipment Costs: The cost of purchasing and maintaining high-performance mining equipment is significant.

- Market Volatility: The value of cryptocurrency can fluctuate rapidly, affecting the profitability of your mining operation.

Potential Returns:

Based on historical data, here are some potential returns:

- Bitcoin Mining: With an average hash rate of 50 TH/s (terahash per second) and an electricity cost of $0.12 per kWh, you can expect to generate around $100-200 per day or $3,000-6,000 per month.

- Altcoin Mining: Mining altcoins (alternative cryptocurrencies) can be more lucrative, with potential returns ranging from $500-2,000 per month.

- Cloud Mining: Cloud mining services allow you to rent mining equipment and infrastructure, which can be more accessible and potentially more profitable than traditional mining.

To Wrap It Up:

Mining cryptocurrency can be a profitable venture, but it’s crucial to understand the complexities involved and make informed decisions. With the right strategy, equipment, and operational plan, you can potentially generate significant returns. However, it’s essential to be prepared for market volatility and adjust your approach accordingly. Remember to always conduct thorough research, consult with industry experts, and carefully consider your risks before investing in cryptocurrency mining.

Leave a Reply